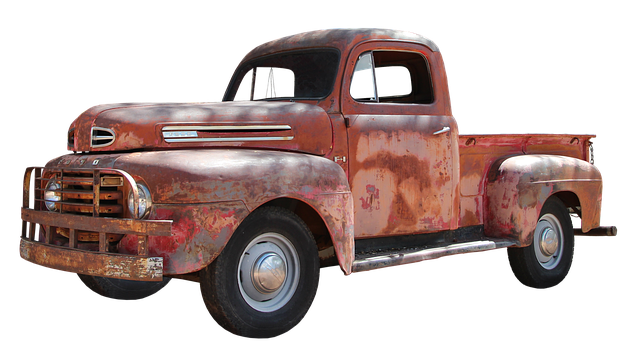

New Year, New Ute?

If you need a new business asset and didn’t make the $150,000 instant asset write off that ended 31 December here’s some good news.

There are new asset rules where you can expense the full purchase price of assets until 30 June 2022.

Any asset first held, and first used or installed ready for use for a taxable purpose, between 7:30pm AEDT on 6 October 2020 and 30 June 2022 can still be expensed, now with no limit.

There are a few things to note, mainly that your aggregated turnover needs to be under $5 Billion and if the asset is pre owned your turnover needs to be under $50 million to expense.

Before you rush out and buy a new ute or machine remember you can only expense the business use portion and vehicles can only be claimed up to $59,136 in 2020/21. Also, some primary production assets, pooled assets, software, overseas assets and all buildings are excluded from the new measures.

Remember to contact Downs Accounting to ensure your claim is allowable and maximised!